Procedures regarding Allotment of Shares. A previously unissued share is allotted when a person acquires an unconditional right to be entered in the register of members in respect of that share.

Allotment Of Shares Appropriation Of Share From The Inappropriate Share Capital Of A Company Ipleaders

At the time of incorporation of a company.

. Investment Association Share Capital. The main purpose of issuing shares is to raise funds for a business. The company secretary.

The process by which members take shares from a company is the issue of shares. Based on 1 documents. In order to raise funds for a company.

The registered name and number of the company. To access this resource sign up for a free trial of Practical Law. A company that offers its shares to the public uses the process of allotment to determine the amount of stock offered to different entities.

For the repayment of the companys borrowings. You must deliver the Return of Allotment of Shares to Companies House within one month of an allotment. There are some details that are required to be collected while allotting the shares.

Authority to allot and pre-emption rights. The next step in the ladder is the process of allotment of shares. Our Customer Support team are on hand 24 hours a day to help with.

Share issue is the process by which companies pass on new shares to shareholders who may themselves be new or existing shareholders. New shares can be issued to either new or existing shareholders. In maximum corporations allotment of share and issue could be the identical process.

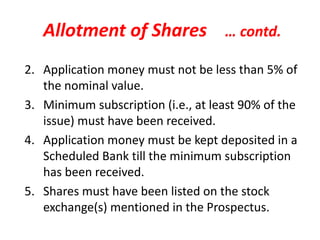

1 Fulfillment of statutory conditions which need to be fulfilled. Before you take any action on changing your share. Over-Allotment Units means the additional number of Private Units the Sponsor will be required to purchase in the event that.

An enterprise can also additionally at any time throughout its lifetime with a view to raise share capital and introduce new shareholders. This form must be completed if you decide to issue allot new shares at any point after incorporation. Step 1 Before you begin the process of onboarding new shareholders it is important to take note of your existing shareholders and their shareholdings.

Important points to review include. Alongside the issue of shares you may see the term share allotment. Consideration whether cash or.

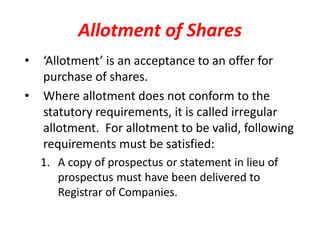

Allotment refers to the structured and systematic distribution of business resources. It means an appropriation of a certain number of shares to an applicant in response to his application for shares. There is a way to simply filling and sending it to.

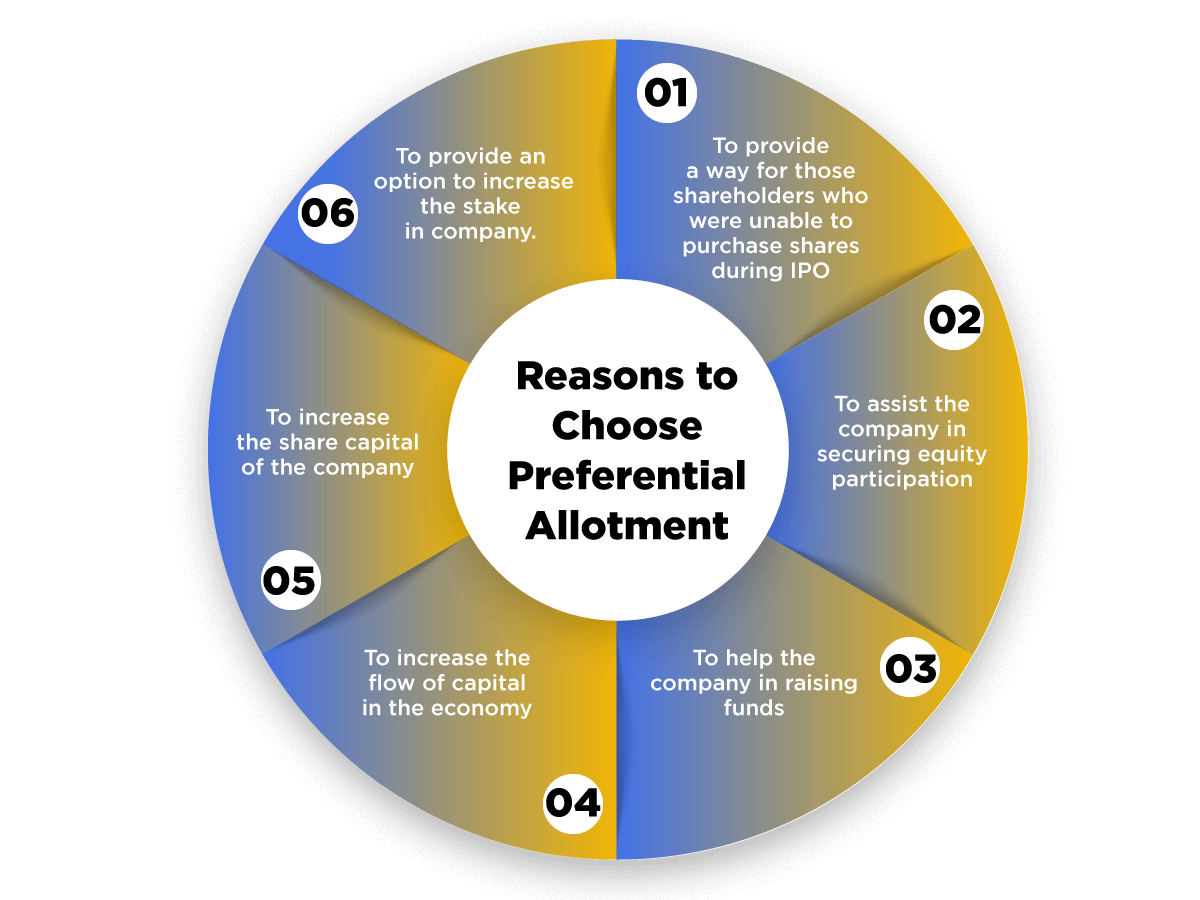

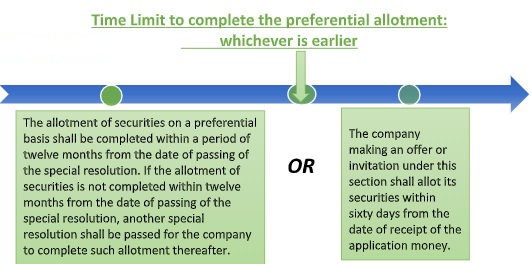

The key difference between allotment and issue of shares is that an allotment is a method of share distribution in a company whereas share issue is the offering of the ownership of the shares to shareholders to hold and later transfer to another investor. Rule 131 of the Companies Share Capital and Debentures Rules 2014 defines preferential allotment as an issue of shares or other securities to a selected group of persons by a company on a. An allotment of shares can be effected by a simple board resolution.

Companies can issue shares to both individuals or corporate bodies and in another article we provide a step by step guide to issue shares. Process of Allotment of Shares. Needless to mention that the prospectus fixes the time when the.

Typically new shares are allotted to bring on new business partners. Such allotment of new shares increases the companys share capital. Sign in to your account.

Details of the shares allotted including. Include the optional continuation pages if needed. Confirm the Shareholdings and Shareholders ID.

Preferential allotment deals with the allotment of shares or securities by a corporate to any person including individuals venture capitalists or others at a pre-determined price. The nominal value of each share. Share allotment can have implications for any existing shareholders share proportion.

This ends with allotment when individual shares are assigned to particular holders. Companies launch IPOs as a means of distributing stock to potential investors but there are other methods of raising. A prospectus is an invitation to the public to purchase shares.

Heres a complete guide as to how a company can start the process of allotment of shares. Free Practical Law trial. Updating the companys PSC register.

Private companies can allot new shares only after filing the Return of Allotment of Shares transaction via BizFile. Payment for allotted shares. Process Of Allotment of Shares.

When are shares allotted and issued. However the law in this area can be quite complex and on occasion it may be necessary to take advice especially as penalties can apply if the rules are not followed. The following rules regarding allotment of shares are noted.

Public companies limited by shares can allot new shares. 1Overview and Key Difference. 7 Procedure on allotment of shares.

The class currency and number of shares. Naturally the intending purchaser has to apply in a prescribed form given in the prospectus for the purpose which is known as application form. Allotting shares for non-cash consideration.

Shares shall mean equity shares of the Company having a par value of Rs 10- Rupees Ten only per equity share with one vote per equity share. Some of the essential reasons to issue new shares are as follows. Allotment means the distribution of job credits based upon need as determined by the community colleges.

Share Allotment Date means the date of allotment of Shares to the Holder upon exercise of the Warrant. Before allotting the shares the company must have a look at the current shareholdings shares that are going to be introduced and the final shareholding structure. Class of Shares refers to the division of Shares into two or more classes as provided in Article III Section 1 hereof.

Share allotment is the creation and issuing of new shares by a company. Issuing shares is an extra complicated process than many might expect. Our All Inclusive Package - the perfect way to form a company.

To raise funds for development or for a new project. This quick guide summarises the key provisions in the Companies Act 2006 regulating the allotment and issue of new shares by a UK company. Post-allotment filing requirements.

An allotment of shares is when a company issues new shares in exchange for cash or otherwise. Allotment means distribution of shares among those who have submitted written application. Return of allotment of shares SH01 Use this form to give notice of shares allotted following incorporation.

The Return of Allotment of Shares is the name of Companies House form SH01. Related to Allotment of Shares. Pre-emption rights on allotment.

An allotment commonly refers to the allocation of shares granted to each participating underwriting firm during an initial.

Meaning Of Allotment Shares Pdf Common Law Private Law

Allotment Of Shares Rules Process And Effects Dns Accountants

Recap Allotment Of Shares Application For Allotment Of Shares Ppt Video Online Download

Right Share Meaning Procedure And Advantages Commerce Rj

Preferential Issue Of Shares Meaning Benefits Procedure

Allotment Of Securities Shares And Debentures Company Law Lectures B Com Sol And Regular Youtube

Compliance Chart For Preferential Allotment Of Shares

Preferential Allotment Of Shares Meaning And Its Procedure Finlawportal

Issue Of Shares Meaning Types And Accounting Treatment Tutor S Tips

Application And Allotment Of Shares Company Law Youtube

26 Allotment Of Shares Meaning And Provisions Conditions Youtube

Nta Ugc Net Set Exams Concept Of Pro Rata Allotment Of Shares Offered By Unacademy

Online Preferential Allotment Reasons Procedure Swarit Advisors

Allotment Of Shares The Process Legistify

Compliance Chart For Preferential Allotment Of Shares Neeraj Bhagat Co

/shares-d4a73d6cb3474bdfa252d1ccdb58d661.jpg)